Hull Coverage Insurance Meaning

The coverage includes all equipment that is used for flying the plane. Aircraft liability insurance and hull insurance which covers physical damage to the aircraft.

Insurance Of Offshore Oil Platforms

The Insurance company carefully evaluated the situation and found that the cost of recovering the ship and the cost of repairing the ship will exceed the value of the ship when repaired.

Hull coverage insurance meaning. There are so many terms you have to comprehend when talking about medical insurance plans that you may feel like you have to be a doctor to understand it all. Hull insurance definition is - insurance protecting the owners against loss caused by damage or destruction of waterborne craft or aircraft. There are two main categories of coverage.

You should look into hull coverage insurance if you own or operate any kind of watercraft for commercial purposes whether a fishing boat or a yacht or any kind of aircraft whether a crop duster or a jet. The insurance definition of hull value is the total of the hull machinery think engines and generators all electronics GPS AIS radios SSB etc and sails and rigging. This can include damages to your vehicles windows.

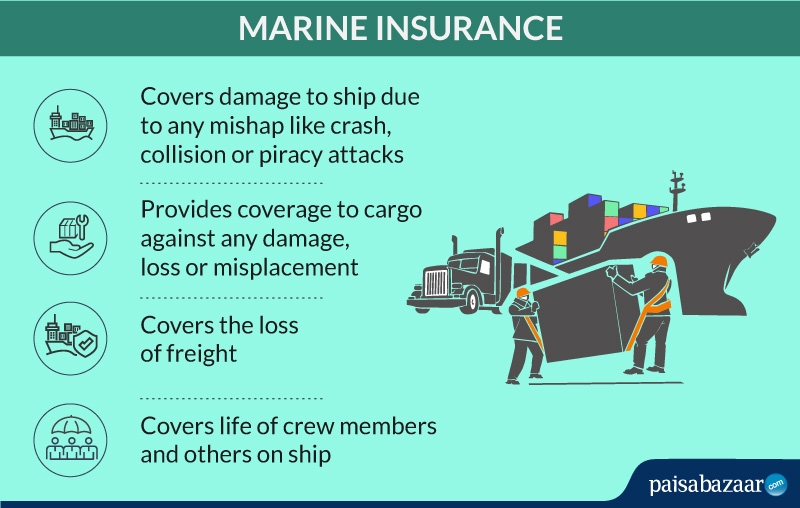

Butfull coverage doesnt actually exist. The term full coverage is often used to refer to a combination of car insurance coverages that help protect a vehicle. Marine hull insurance is an insurance policy specifically designed to provide coverage to water vehicles like a boat ship yacht fishing boat steamer etc.

It covers the transportation against. Comprehensive auto insurance offers coverage for damages that your vehicle sustains that are not the result of a collision with another vehicle. Hull insurance is an insurance policy especially designed for covering ship damage expenses.

A hull means the body of the vessel and that is exactly what is covered by this insurance policy. We hope the you have a better understanding of the meaning of Hull Coverage. Skip to main content.

Hull Coverage marine or aviation insurance covering damage sustained to an insured vessel or airplane. Hull insurance can be understood like a car insurance with a difference of being for a water faring vehicle instead of land. The purpose of insurance is to make you whole after a loss.

To protect themselves businesses should buy aviation insurance. However to recover on a hull policy the loss must have been occasioned by a peril insured against. Full coverage is a common term used in auto insurance.

ISO commercial general liability CGL policy by way of the damage to property exclusion which precludes coverage for property damage PD to property in the insureds care custody or. State-mandated minimum liability or bare-bones coverage needed to legally drive a car. Commercial general liability policy by way of the damage to property exclusion which precludes coverage for property damage PD to property in the insureds care custody or control Thus many aircraft insurance policies include physical damage or hull coverage.

Policies and coverage offered by insurers will vary by state. Hull policy coverage is subject to perils of the seas interpretation Marine hull insurance affords shipowners protection against physical damages and losses to their vessels. Full coverage liability of 100000 per person injured in an accident you cause up to 300000 per accident and 100000 for property damage you cause 100300100 with a 500 deductible for comprehensive and collision.

In some states full glass. A typical full coverage policy has liability plus comprehensive and collision coverages and depending on state law requirements may include uninsured motorist and a medical coverage of personal injury protection pip or medical payments medpay. If youre wondering what constitutes Full Health Coverage you need to consider a few different things.

They can be purchased together or separately and in a variety of iterations. For example if your car is damaged by hail a fallen tree an act of vandalism or even an animal a comprehensive auto insurance policy will help to cover the cost of those damages. Marine hull and liability insurance.

It can also include other options that you may want or need. What Does Aircraft Hull Insurance Mean. Full coverage insurance definition.

Hull Insurance covers the hull torso of the transportation vehicle. Think about everything necessary to. Updated May 20 2021.

Marine Liability insurance is where compensation is bought to provide any liability occurring on account of a ship crashing or colliding. It can also help with losses resulting from flood hail and when you hit an animal. Marine hull and liability insurance covers damage or loss to the vessel including its machinery and equipment as well as legal liability to any third party due to negligence related to the vessels operations or the actions of masters or crew.

It often refers to a package that includes liability collision and comprehensive insurance. Additional coverages help you personalize your car insurance policy. Property damage to an aircraft a business entity owns or operates is excluded under the Insurance Services Office Inc.

Health coverage can be difficult to understand. Aircraft hull insurance provides coverage for the physical damage of an airplane whether the damage occurs on the ground or in flight. It covers your vehicle in the event of a theft or vandalism.

Comprehensive is coverage for damage to your vehicle. Simply described hull coverage insurance is a common type of insurance that covers the owners of watercraft or aircraft against loss resulting from damage to their craft. Your answer should be yes.

So the insurance company decided to settle the claim with the help of constructive total loss clause mentioned in the Marine hull insurance policy. Full coverage auto insurance indiana mar 2021. Hull Coverage Marine or aviation insurance covering damage sustained to an insured vessel or airplane.

Where the Hull refers to the main body of the ship. Hull Coverage Aircraft property damage to an aircraft a business entity owns or operates is excluded under the Insurance Services Office Inc. Car Insurance Full Coverage Meaning Sep 2021.

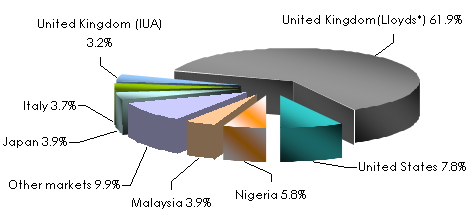

Marine Insurance Meaning Types Benefits Coverage Drip Capital

Akan Fertility Doll The Egyptian Ankh Egyptian Ankh Kemetic Spirituality

Marine Insurance Meaning Types Benefits Coverage Drip Capital

What Does Hull Coverage Insurance Cover

Marine Insurance Meaning Types Benefits Coverage Drip Capital

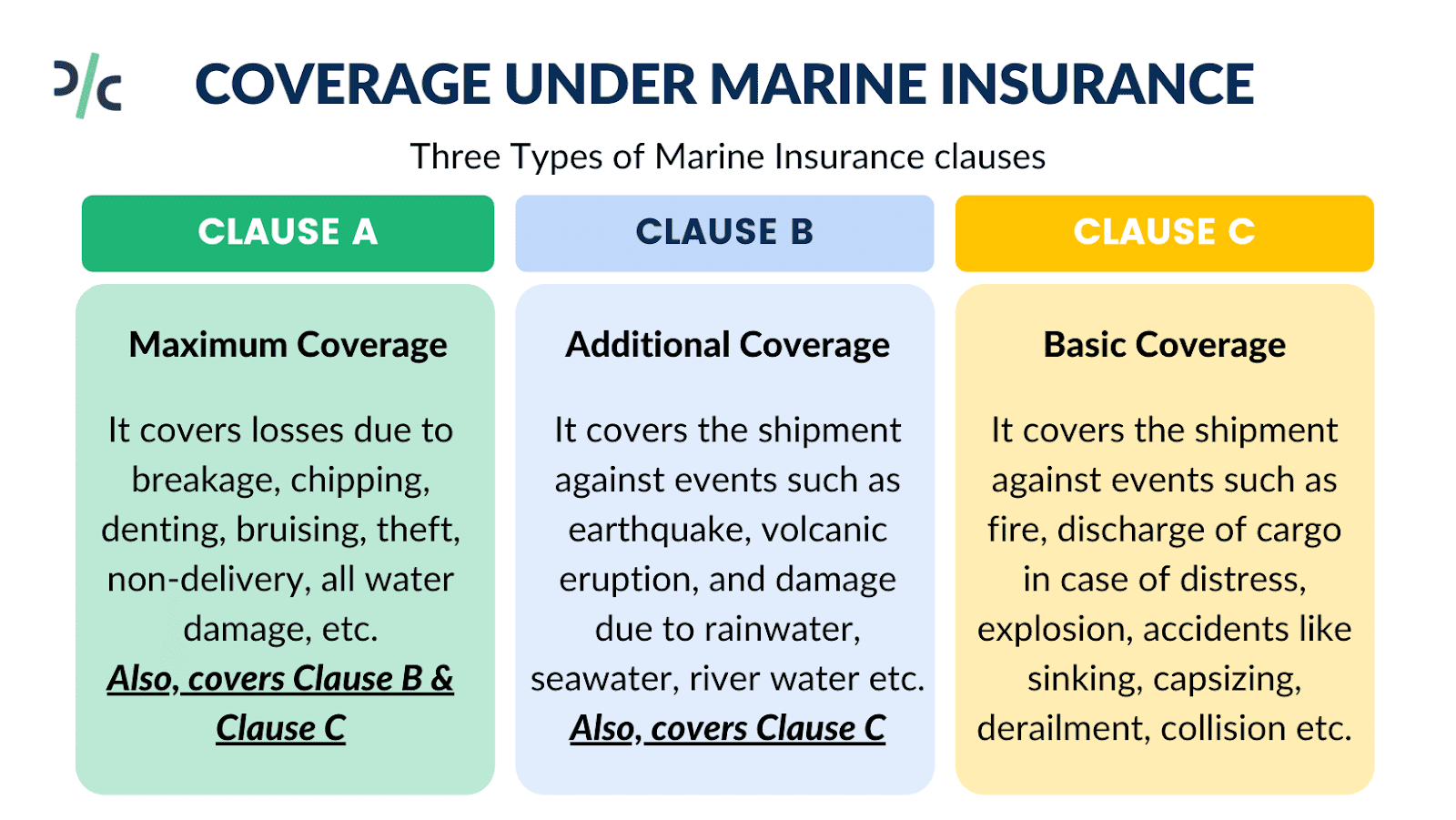

Types Of Marine Cargo Insurance Coverage Trade Risk Guaranty

Viking Again Viking Yachts Yacht Motor Yacht

Be Passionate But Don T Invest In Emotions Investing Motivation Inspiration Quote Loveandprotection Financial Quotes Stock Market Quotes Stock Market

40 Fotos De Animales Albinos Albino Animals Rare Animals Rare Albino Animals

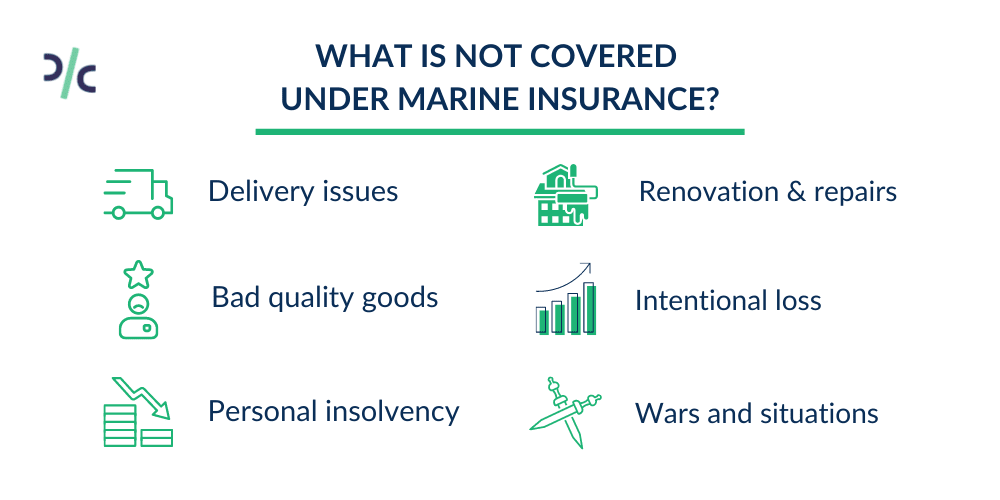

Marine Insurance In India Types Coverage Claim Exclusions

How To Germany Driving In Germany Vilseck Germany German Road Signs Learn German

Equipments For The Safe Surroundings Fire And Safety Engineering Safety Training Fire Safety

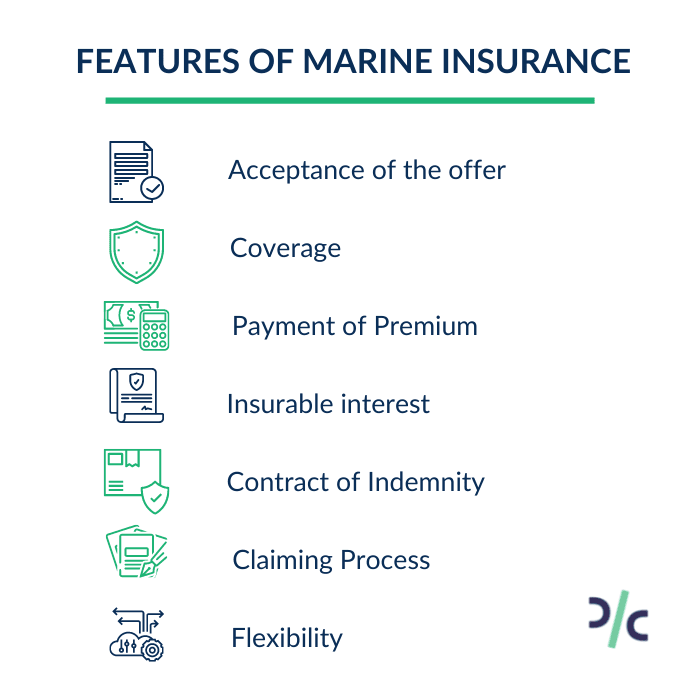

Essential Features Of A Marine Insurance Contract By Enterslice

Steven Robson S T140 Scrambler Scrambler Triumph Bikes Bike Shed

Photo By Jeff Angeleri Boat Yacht Marine

Aa Talk Hull Insurance Clauses Agency Commission Unrepaired Damage

Download In Pdf Risk Management And Financial Institutions R A R Risk Management Financial Institutions Online Textbook

Make Sure Your Car Is Covered If Someone Rear Ends You Call Us At 323 277 2850 Funny Jokes Jokes Funny License Plates

Posting Komentar untuk "Hull Coverage Insurance Meaning"