Uber Optional Insurance Coverage

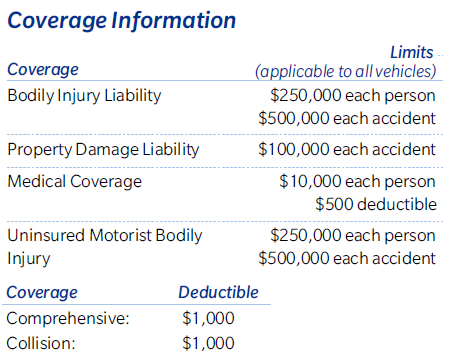

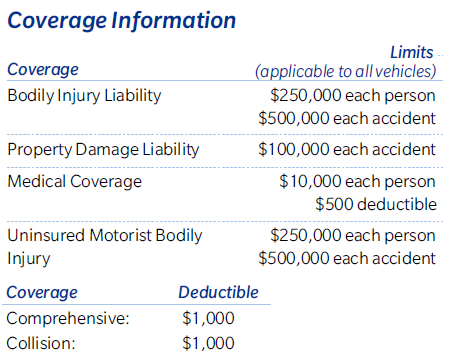

After the rideshare insurance coverage is purchased your status on the rideshare app determines coverage. If the app is on and youre available for hire coverage extends from your personal auto policy and may include liability coverage for property damage and injury to others physical damage coverage for damage to your car and emergency roadside service.

Delivery Driver Insurance Uber

Collision and comprehensive.

Uber optional insurance coverage. In most states that includes liability underinsured motorist and personal injury coverage. This insurance program is offered by Ubers partner Aon. Some policies will cover Uber drivers aged as young as 21 years old but these will likely be expensive.

Aon Affinity is offering this optional coverage to Uber drivers. Safecos personal auto policy excludes vehicles being used as a public or livery conveyance such as taxis. Safeco now offers Auto RideSharing Coverage for drivers who work for a ride hailing company such as Uber or Lyft driving their personally owned vehicles.

However this coverage is contingent and comes with a 1000 deductible. When the Uber app is off a driver is covered by their own personal car insurance. Uber requires all their drivers to have car insurance and provides supplemental insurance coverage but only while the app is on.

This commercial auto insurance partnership between Uber and Economical helps protect. This optional coverage also pays for the cost of replacement car up to 3000 per event while yours is being repaired. Make sure you have minimum liability coverage.

This optional insurance program is offered by Aon. Uber Eats will provide physical damage coverage for your vehicle up to its actual cash value regardless of who is at fault. OPTIONAL INJURY PROTECTION OVERVIEW Get peace of mind while you drive and deliver.

If there is a conflict between the information shown here and the actual insurance policy the policy will govern. The rideshare insurance maintained by Uber insures Uber partners for bodily injury and property damage liability to third parties resulting from a covered accident such as your riders people in other vehicles. Most of Ubers taxi insurance policies will have lower age restrictions and youre unlikely to find a good deal if you are under the age of 25.

52 rows Lyfts or Ubers insurance policies cover this period. On July 7 2016 FSCO approved an automobile insurance policy through Intact Insurance Company that covers all Uber drivers passengers and vehicle owners. Uber drivers age restrictions.

- 50000 for the drivers liability for bodily injury per person case of a covered accident - 100000 per covered accident - 25000 for. The deductible means youll have to pay 1000 out-of-pocket before Ubers coverage kicks in to cover your claim. You can find your Certificate of Insurance in the Driver app by tapping Account in the app menu then Insurance and tap on a coverage.

Heres how it works. A link to the policy is here. This coverage comes with a 1000 deductible.

How to get car insurance as an Uber driver. Uber Technologies is not an insurance provider and is not performing any insurance services. This insurance offers several important accident benefits for driver-partners.

Optional Injury Protection provides medical coverage for covered accidents along with additional benefits such as disability earnings replacement and survivor benefits while youre online with Uber. Additional Uber purchased liability insurance will apply if damages exceed 200000 the liability insurance included with basic plate insurance. As of September 1 2020 drivers with Uber across Ontario Quebec Alberta and Nova Scotia will automatically receive commercial auto insurance coverage issued by Economical Insurance whenever using the app.

Ride-hailing companies may purchase a blanket Optional policy that would apply to its drivers. The policy also includes 2 million of uninsured motorist coverage. According to belairdirect insurance reviews it offers an optional coverage called Autocomfort which includes 55000 rental car coverage.

For less than four cents a mile Optional Injury Protection helps minimize the financial impact an accident could have on you and your family. Uber car insurance requirements. Phases 2-3 coverage of 1 million liability per incident plus comprehensive and collision up to the value of your car.

A Certificate of Insurance provides important information about the coverage that Uber maintains on your behalf. If you have optional coverages ie above the basic level of coverage you should contact your auto-insurance broker or visit the MPI website to see what is allowed under your policy and if additional coverage is needed. Uninsured and underinsured motorist coverage UMUIM for short is an optional insurance coverage motorists can buy to supplement the at-fault drivers insurance coverage.

UBERS INSURANCE PROGRAM COVERAGE STARTS THE INSTANT YOU TAP GO ON THE UBER APP TO WAIT FOR A RIDE REQUEST From the time youre online with Uber until you accept a trip Uber maintains automobile liability coverage on your behalf in amounts of at least. If you are active on the Uber platform for more than 4 days per month you will need to contact your auto-insurance broker or visit the MPI website to obtain business coverage. Commercial auto insurance coverage issued by Economical.

Driver Injury Protection helps minimize the financial impact an accident could have on Uber Driver Partners and their families. This means if a driver hits you and the driver has inadequate coverage or no coverage at all your own UMUIM policy will supplement or stand in for the at-fault drivers insurance policy to help pay for the damages. Phase 1 liability of 50000 bodily injury per person 100000 bodily injury per accident 25000 property damage per accident.

If you do not have comprehensive and collision coverage which is optional in every state then Uber does not cover the value of your vehicle. Uber also offers other optional insurance that you may consider. You should check with the ride-hailing company whether they have any blanket Optional coverage.

A ride hailing company is also known as a Transportation Network Company TNC. When the Uber app is turned on a. No coverage during any period.

The only insurance Uber requires drivers get is the legally mandated state minimum required liability coverage. Uber offers comprehensive and collision insurance that will cover up to your cars cash value. The Uber purchased policy provides 2 million in liability limits.

Optional injury protection includes benefits like disability payments and no deductibles when filing a claim. Optional coverage such as Collision and Comprehensive is available to provide coverage when offering ride-hailing services. The policy is underwritten by Atlantic Specialty Insurance Company.

Calameo Car Insurance Definition

Auto Insurance Types And Purpose Of Coverage

Uber Lyft Upgrade Insurance For Drivers Is That Enough

What Is Insurance That Covers Uber What You Need To Know

Uber Driver Insurance How It Works What It Covers

How Does Rideshare Insurance Work Freeway Insurance

Optional Injury Protection For Drivers Insurance Uber

8 Types Of Car Insurance Explained Car Insurance Insurance Direct Auto Insurance

Uber Pro Drivers Inshur Professional Motor Insurance

Blog Do You Need Gap Insurance 48140 Joe Turner Dan Cummins Chevrolet Buick Car Insurance Tips Cheap Car Insurance Quotes Car Insurance Rates

Proteccion Contra Lesiones Personales Para Socios Conductores Uber

Uber Driver Insurance How It Works What It Covers

Cheap Car Insurance Quotes For Chevrolet Trax In New Jersey Nj Mx 5 W A Volkswagen

Did Uber Just Raise Their Insurance Deductible To 2 500 Uberdrivers

Proteccion Contra Lesiones Personales Para Socios Conductores Uber

How Uber Accident Claims Work In Pennsylvania Cordisco Saile

Uber Insurance Requirements For Michigan Michigan Auto Law

Posting Komentar untuk "Uber Optional Insurance Coverage"